Finding the cheapest estate agent fees in the UK is essential for anyone selling, renting, or letting property. Estate agent fees can vary significantly, depending on whether you choose a traditional agent, an online platform, or a hybrid service. Knowing how to navigate these options can save thousands while ensuring your property achieves the best possible sale price.

It’s important to understand that the cheapest estate agent fees are not always the lowest in terms of service quality. Some agents offer fixed fees or low percentages but may compromise on marketing or negotiation skills. By researching and comparing fees, homeowners can balance cost and results effectively, ensuring the best outcome for their property sale or rental.

What Are Estate Agent Fees

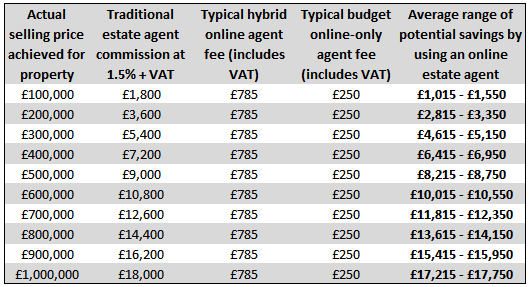

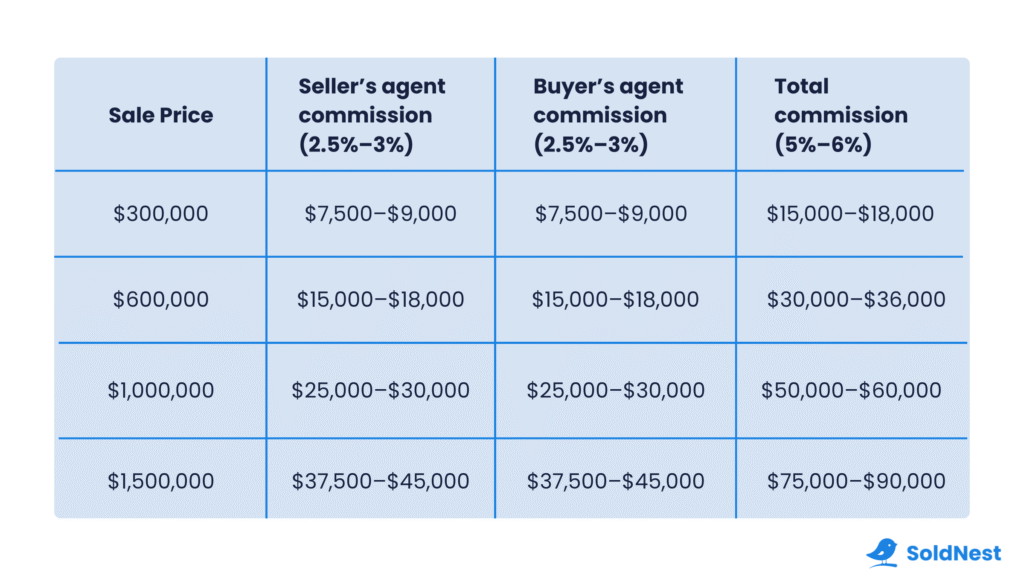

Estate agent fees are the charges applied by agents to manage the sale, rental, or letting of a property. These fees can be a percentage of the final sale price or a fixed amount depending on the agent and the services provided. Traditional agents typically charge between 1% and 3.5%, while online platforms offer fixed fees that can be considerably cheaper.

Fees also differ depending on whether the property is being sold, rented, or let. Letting agents often charge a lower percentage or monthly management fees, whereas cash buyers and iBuyers may eliminate fees but offer a lower sale price. Understanding these variations allows homeowners to identify the cheapest estate agent fees suitable for their situation.

How to Find the Cheapest Estate Agent Fees Near You

Finding the cheapest estate agent fees near you starts with thorough research. Begin by searching online for local agents and comparing their fees, services, and reviews. Online agents often provide cheaper fixed fees, while traditional agents may offer lower commission rates if you negotiate. Understanding the local market is essential for identifying the most cost-effective options.

Visiting multiple agents and requesting detailed quotes is another effective strategy. Ask what is included in the fee, such as professional photography, viewings, and marketing campaigns. Comparing these elements allows you to find the cheapest estate agent fees without sacrificing essential services, helping you save money and sell your property efficiently.

Using Calculators to Compare Estate Agent Fees

Estate agent fee calculators are powerful tools for comparing different agents’ charges. By entering your property’s estimated value, these calculators can estimate fees for both fixed and percentage-based services. This allows you to quickly identify the cheapest estate agent fees while considering the potential impact on your net proceeds.

Many UK websites offer free calculators, making it easier to weigh your options. These tools also allow you to compare online agents against traditional agents and assess whether a slightly higher fee might result in a higher sale price. Using calculators is a smart approach to ensure transparency and secure the most cost-effective agent.

Cheapest Options for Selling, Renting, and Letting

There are several strategies to achieve the cheapest estate agent fees when selling a property. Fixed-fee online agents often provide significant savings compared to traditional agents, while negotiating a lower percentage with a local agent can also reduce costs. Choosing a sole agency agreement instead of multi-agency can further cut fees.

For renting and letting, online platforms or self-managed landlord services often offer cheaper options than full-service letting agents. Cash buyers and iBuyers may eliminate fees completely, though they may offer lower prices. Always evaluate the overall net proceeds against upfront fees to ensure you are choosing the most financially beneficial option.

Regional Differences and Specialist Tips

Estate agent fees vary depending on your property’s location. London agents often charge higher fees due to market demand, while smaller towns like Northampton or regional cities usually offer cheaper rates. By understanding these regional differences, homeowners can negotiate more effectively and identify the cheapest estate agent fees locally.

For international comparisons, such as in Ireland, fees can differ significantly. Always ensure that you know exactly what is included in the fee and whether VAT is applied. Negotiating with agents and comparing multiple quotes can significantly reduce costs while ensuring high-quality service and a smooth property transaction.

Hidden Costs to Watch Out For

Even when you find the cheapest estate agent fees, hidden costs can affect your total expenditure. Agents may charge for marketing, photography, or additional viewings. Some online agents offer low upfront fees but limit services, which can impact your property’s visibility and sale price.

It’s essential to ask agents for a full breakdown of all fees before signing a contract. Comparing agents based on both their fees and the services included ensures you truly get the cheapest estate agent fees without compromising quality, transparency, or results.

Conclusion

Securing the cheapest estate agent fees in the UK requires careful research, comparison, and negotiation. Using fee calculators, exploring both online and traditional agents, and considering regional differences can save homeowners significant money. While low fees are appealing, always focus on the net result and service quality to achieve the best outcome.

By being informed and proactive, homeowners can balance cost with service, ensuring that they pay the lowest possible estate agent fees without sacrificing results. A well-planned strategy can make the process smoother, faster, and more profitable.