Understanding total exemption full accounts is essential for small companies operating in the UK. These accounts allow small businesses to provide full financial transparency without undergoing a mandatory audit. For many small and dormant companies, this filing type strikes a balance between regulatory compliance and cost efficiency, making it a preferred option for directors who want to maintain accuracy in their financial reporting while avoiding unnecessary expenses.

Filing total exemption full accounts ensures that a company meets its legal obligations under the Companies Act 2006. Even though these accounts are exempt from audit, they must still include all required financial statements, such as the balance sheet, profit and loss account, director’s report, and notes. This allows companies to maintain transparency with shareholders, investors, and regulatory authorities, enhancing trust and accountability in business operations.

What Are Total Exemption Full Accounts?

Total exemption full accounts are a specific type of company filing in the UK where certain small companies are exempt from conducting a statutory audit but must submit full financial statements. These accounts provide a complete picture of the company’s financial performance and position, including the balance sheet, income statement, and detailed notes. They are often used by small or dormant companies who want to comply with the law while avoiding audit costs.

The purpose of total exemption full accounts is to give smaller businesses the opportunity to provide transparency without the additional burden of a full audit. Companies that qualify for this type of filing meet specific thresholds relating to turnover, balance sheet totals, and employee numbers. Using these accounts enables small companies to demonstrate financial accountability while keeping compliance straightforward and affordable.

Criteria for Filing Total Exemption Full Accounts

Eligibility for filing total exemption full accounts depends on certain criteria set out in UK company law. To qualify, companies must meet thresholds related to turnover, balance sheet total, and the number of employees. This ensures that only genuinely small businesses are exempt from audit, while still providing comprehensive financial statements for shareholders and regulatory bodies.

Dormant companies or certain subsidiaries may also qualify for total exemption full accounts if they meet the necessary criteria. Understanding these requirements is crucial for directors and business owners, as filing incorrectly can lead to penalties or compliance issues. Checking eligibility before preparing accounts helps ensure companies take advantage of audit exemptions while remaining fully compliant.

Components of Total Exemption Full Accounts

The main components of total exemption full accounts include the balance sheet, income statement, director’s report, and notes to the accounts. Each section plays a vital role in showing a complete picture of a company’s financial health, highlighting assets, liabilities, equity, profits, and losses. Together, these documents ensure that small companies comply with statutory reporting requirements.

The balance sheet in total exemption full accounts provides a snapshot of what the company owns and owes at the end of the accounting period, while the income statement reflects business performance over the year. Notes and the director’s report give context to the figures, including accounting policies, explanations of key items, and disclosures that help stakeholders understand the financial statements in detail.

How to File Total Exemption Full Accounts with Companies House

Filing total exemption full accounts with Companies House involves a clear, step-by-step process. Companies must first prepare accurate financial statements that meet all statutory requirements. Once prepared, the accounts can be submitted electronically or on paper, depending on company preference. Timely filing is essential to avoid penalties and ensure compliance.

Common mistakes when filing total exemption full accounts include missing or incomplete notes, inaccuracies in the balance sheet, and late submission. Directors should review all documents carefully, ensuring consistency and correctness. Filing total exemption full accounts not only satisfies regulatory obligations but also helps maintain the company’s credibility and financial transparency in the eyes of investors and partners.

How to Read and Interpret Total Exemption Full Accounts

Understanding total exemption full accounts is important for directors, investors, and financial professionals. Reading these accounts effectively allows stakeholders to assess the company’s financial health, profitability, and overall performance. Key areas include the balance sheet, income statement, and notes, which reveal essential information about assets, liabilities, revenue, and expenditures.

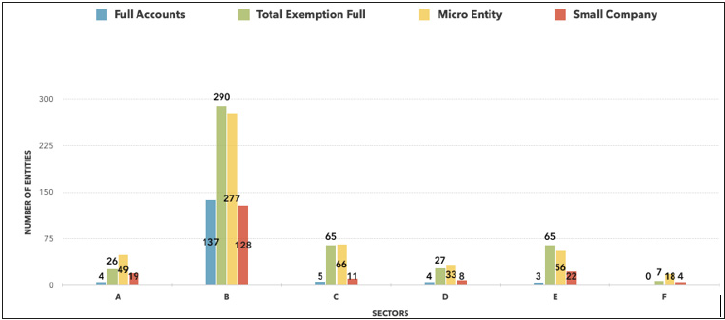

Interpreting total exemption full accounts helps identify trends, risks, and opportunities. Comparing these accounts with micro-entity or abridged accounts offers a broader understanding of a company’s position and operational efficiency. By analysing key figures and disclosures, directors can make informed decisions that support long-term growth, while investors can gain confidence in the company’s financial stability and transparency.

Benefits of Using Total Exemption Full Accounts

Using total exemption full accounts provides several advantages for small UK companies. First, it offers full compliance with legal requirements while avoiding the costs of a statutory audit. Second, it allows businesses to maintain transparency and credibility with shareholders and stakeholders. This can enhance relationships with investors and lenders who rely on accurate financial reporting.

Another key benefit of total exemption full accounts is simplicity and efficiency. Companies can prepare comprehensive accounts without the complexity of a full audit, saving time and resources. This makes it easier for small business owners to focus on growth and operations, while still meeting all necessary reporting standards and ensuring compliance with Companies House and HMRC requirements.

Conclusion

Total exemption full accounts provide a practical and cost-effective solution for small companies in the UK. These accounts ensure transparency, accountability, and legal compliance, while freeing businesses from the additional burden of statutory audits. By understanding eligibility, components, and filing procedures, directors can confidently prepare and submit accurate financial statements.

Filing and interpreting total exemption full accounts correctly allows small companies to maintain financial clarity, build trust with stakeholders, and make informed strategic decisions. Companies that use these accounts effectively can benefit from simplified compliance, reduced administrative costs, and a clear picture of their financial health, supporting growth and long-term success.